Heard terms like Bitcoin, Ethereum, or “crypto” thrown around and felt a bit lost? You’re not alone! The world of digital assets can seem complex, but at its core, the idea is quite revolutionary. This guide is here to decode cryptocurrency for you, simply and clearly.

So, What Exactly Is Cryptocurrency?

Think of cryptocurrency as digital or virtual money. Unlike the dollars, euros, or yen in your physical wallet or bank account (which are increasingly digital too, but controlled by banks and governments), cryptocurrency exists purely in the digital realm.

The “crypto” part comes from cryptography – the science of secure communication. Cryptocurrencies use complex coding techniques to secure transactions, control the creation of new units, and verify the transfer of assets. It’s like having a super-secure digital vault and ledger system, all rolled into one.

In simple terms: Cryptocurrency is internet-native money secured by code, not by banks or governments.

What Makes Cryptocurrency Different? (Key Features)

Cryptocurrencies have some unique characteristics that set them apart from traditional money:

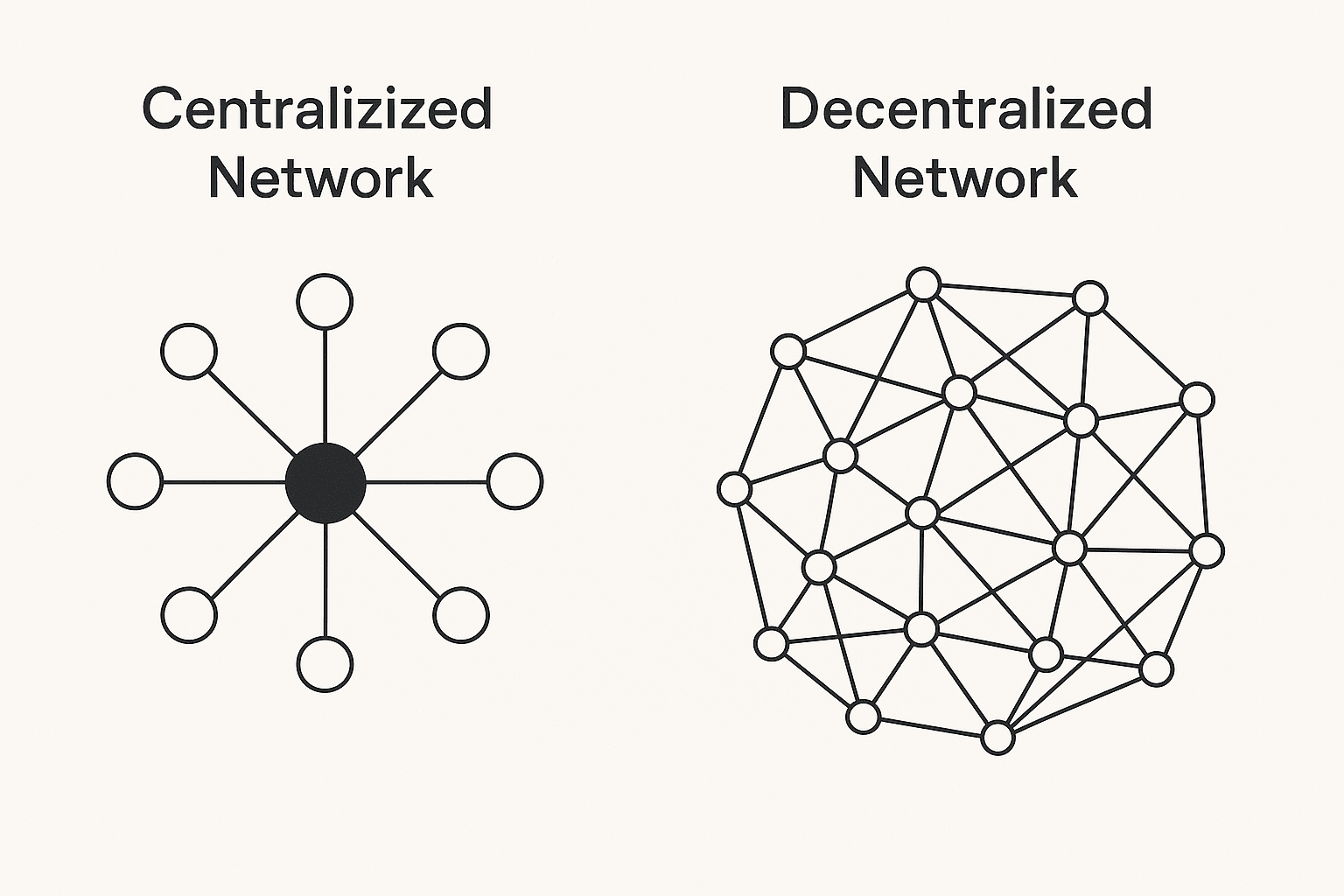

1. It’s Often Decentralized: No Single Boss

This is perhaps the most crucial difference. Most traditional currencies are controlled by a central authority, like a central bank (e.g., the Federal Reserve in the US). They decide how much money to print and set the rules.

Many cryptocurrencies, like Bitcoin, are decentralized. This means they aren’t controlled by any single entity. Instead, they operate on a distributed network of computers around the world. Decisions are often made collectively by the network participants based on pre-defined rules in the code.

2. It’s Secured by Cryptography: Super Strong Digital Locks

As mentioned, cryptography is key. It makes transactions highly secure and prevents things like counterfeiting or someone spending the same digital coin twice (known as the “double-spending problem”). Think of it as using incredibly complex mathematical puzzles to verify every transaction.

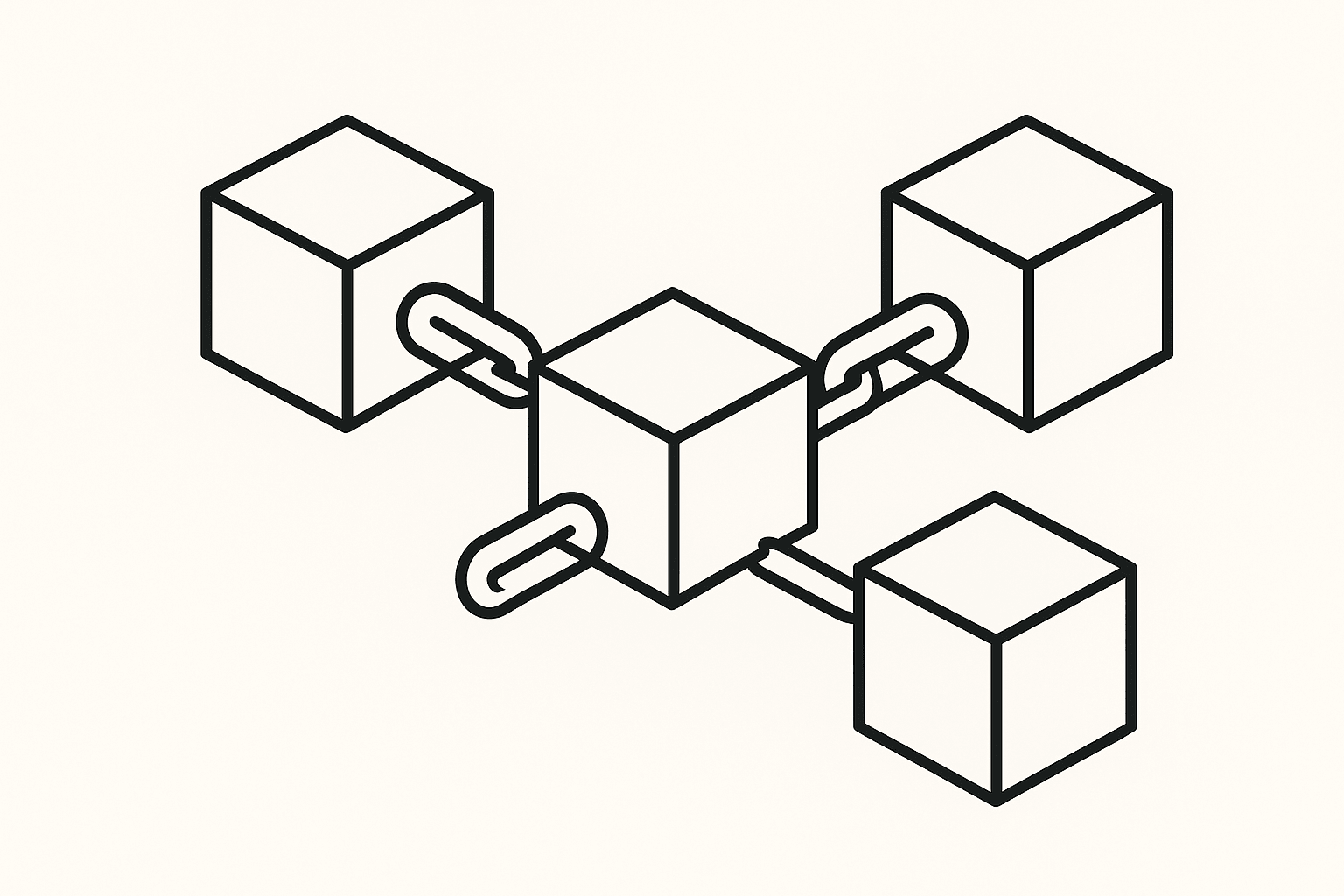

3. Transactions are Often Recorded on a Blockchain

Most cryptocurrencies use a technology called blockchain. Imagine a shared, digital ledger book that’s duplicated and spread across many computers in the network. When a transaction happens, it’s recorded as a “block” of data and added to the “chain” in a chronological and permanent way.

Because this ledger is shared and verified by many, it’s very difficult (practically impossible) to tamper with or cheat the system. We’ll dive deeper into blockchain in another article!

Why Should Anyone Care About Cryptocurrency?

You might be wondering, “Okay, it’s different, but why does it matter?” Here are a few reasons people are interested:

- Potential for Lower Fees: Sending money internationally through banks can involve hefty fees. Crypto transactions, especially on certain networks, can sometimes be cheaper.

- Faster Transactions: International bank transfers can take days. Some crypto transactions can be confirmed in minutes or even seconds.

- Accessibility: Anyone with an internet connection can potentially access and use cryptocurrencies, regardless of their location or access to traditional banking systems (though getting started often requires interaction with the traditional system).

- Transparency: While users can be pseudonymous (not directly tied to real-world identities easily), most transactions on public blockchains (like Bitcoin’s) are transparent and viewable by anyone.

- Investment Potential: Let’s be honest, many people are interested in crypto as an investment, hoping its value will increase over time. However, this comes with significant risks due to high volatility.

Famous Examples: Bitcoin and Beyond

You’ve almost certainly heard of Bitcoin (BTC). It was the first cryptocurrency, created in 2009, and remains the largest and most well-known. Think of it as the pioneer that started it all.

Ethereum (ETH) is another major player. It’s different because its blockchain allows developers to build applications on top of it (like apps on your phone, but decentralized). This has led to innovations like Decentralized Finance (DeFi) and Non-Fungible Tokens (NFTs).

Beyond these two, there are thousands of other cryptocurrencies, often called “altcoins,” each with different goals, technologies, and uses.

Is it ‘Real’ Money Though?

This is a common question. Can you buy your groceries with Bitcoin? Mostly, not directly yet. While acceptance is growing, it’s not universally used like traditional currency.

Think of it more like a new type of digital asset. Some people use it for transactions, some hold it as an investment (like digital gold), and others use it to interact with specific online applications.

Important Note: Cryptocurrencies are known for being highly volatile. Their prices can swing dramatically in short periods. It’s crucial to understand the risks before getting involved.

The Takeaway: Digital Money for a Digital World

Cryptocurrency is essentially a form of digital money secured by code and typically operating outside the control of traditional banks and governments. It relies on cryptography for security and often uses blockchain technology to record transactions transparently.

While it started with Bitcoin, the crypto world has expanded massively, offering potential benefits like faster transactions and greater accessibility, but also carrying risks like price volatility.

Understanding the basics is the first step in decoding this exciting and evolving space. Keep exploring Decoding Crypto World to learn more!