Binance has emerged as one of the most influential and trusted cryptocurrency exchanges in the world. With a diverse range of trading products designed for both beginners and experienced traders, Binance offers a robust ecosystem that caters to every trading style. In this comprehensive guide, we delve into the major trading products available on Binance. You will discover detailed explanations of spot trading, futures, margin trading, and staking and savings options. Our aim is to help you understand each product, assess the risks, and seamlessly integrate these tools into your trading strategy. Whether your goal is to trade actively, invest for passive income, or explore advanced derivatives, this guide provides the information you need to make confident decisions in the ever-evolving crypto market.

Understanding Binance Trading Products

Binance offers a rich selection of trading products that cater to diverse investor profiles. The platform accommodates simple buy-and-sell transactions as well as complex leveraged trades. By providing an array of options—from spot trading, which serves as the foundational method for buying and selling digital assets, to advanced futures and margin trading for those seeking higher risk-reward opportunities—Binance ensures that every trader can find a suitable instrument. In addition, Binance continuously innovates by integrating tools for technical analysis, real-time market data, and secure fund management, making it a one-stop destination for crypto trading.

Spot Trading – The Foundation of Crypto Trading

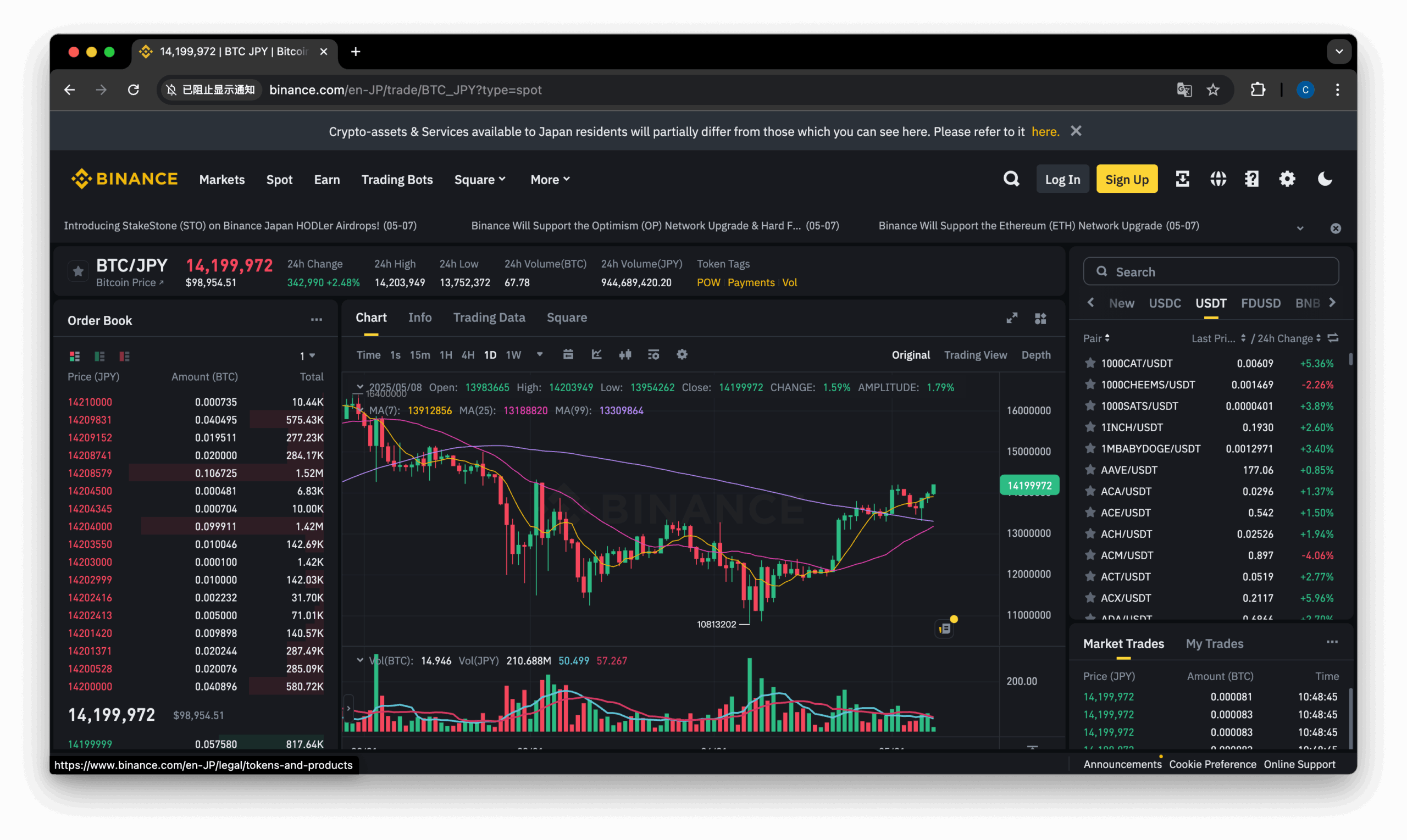

Spot trading is the most straightforward method of trading on Binance. It involves the immediate exchange of cryptocurrencies at current market prices. This method is ideal for traders who wish to invest in digital assets without the complexity of derivatives or leverage. On the platform, users can choose among a wide variety of trading pairs, enabling them to exchange Bitcoin for Ethereum or vice versa, depending on market conditions and personal strategies. Orders can be placed as market orders for instant execution or limit orders to set a desired price level.

One of the main advantages of spot trading is its simplicity and the transparency offered by Binance’s user-friendly interface. The platform provides detailed charts and order book information, allowing traders to monitor price movements and market depth in real time. This level of clarity is particularly useful for new traders who are learning the basics of market dynamics. The absence of leverage in spot trading also translates into lower risk, making it an entry point for beginners and a reliable method for experienced investors looking to build fair value positions.

Futures and Perpetual Contracts – Advanced Trading Options

For traders looking to explore opportunities beyond simple asset exchange, Binance offers futures and perpetual contracts. These advanced products enable you to speculate on the future prices of cryptocurrencies. Futures trading provides an opportunity to hedge positions or take advantage of market volatility through leveraged trades. Perpetual contracts, on the other hand, do not have a fixed expiration date. These contracts mirror the performance of the underlying asset and are designed to offer continuous exposure to market movements.

However, it is important to note that leveraging these financial instruments comes with added risks. The combination of leverage and market volatility means that while potential profits can be magnified, so can losses. Binance provides a comprehensive set of risk management tools including stop-loss orders and margin call alerts to help traders manage these inherent risks. Additionally, educational resources and demo trading sessions are available to help traders become familiar with the mechanics of futures and perpetual contracts.

The futures market on Binance is designed with transparency and user support in mind. Traders have access to real-time data and analytical tools that help in making informed decisions. Whether you are hedging a spot position or speculating on market trends, futures trading provides a dynamic environment to apply advanced strategies.

Margin Trading – Leverage Trading for Experienced Users

Margin trading on Binance offers investors a unique opportunity to trade larger positions than the capital available in their account balance. By borrowing funds from the platform, traders can amplify their exposure to potential price movements. This leverage means that even small market movements can significantly impact the profitability of a position, making margin trading a double-edged sword.

Given its increased risk profile, margin trading is best suited for experienced users who have a robust understanding of risk management principles and market conditions. Binance has put in place a range of features to assist margin traders, such as real-time margin ratio monitoring, liquidation safeguards, and detailed reporting of borrowed funds versus owned capital. These measures help ensure that traders are fully aware of the risks and can take proactive actions to safeguard their positions.

The platform also offers in-depth tutorials and expert guidance on how to effectively use margin trading. With a clear emphasis on responsible trading, Binance strives to provide all the necessary tools to enable traders to explore leverage responsibly while protecting their investments.

Staking and Savings – Earn Passive Income with Your Crypto Assets

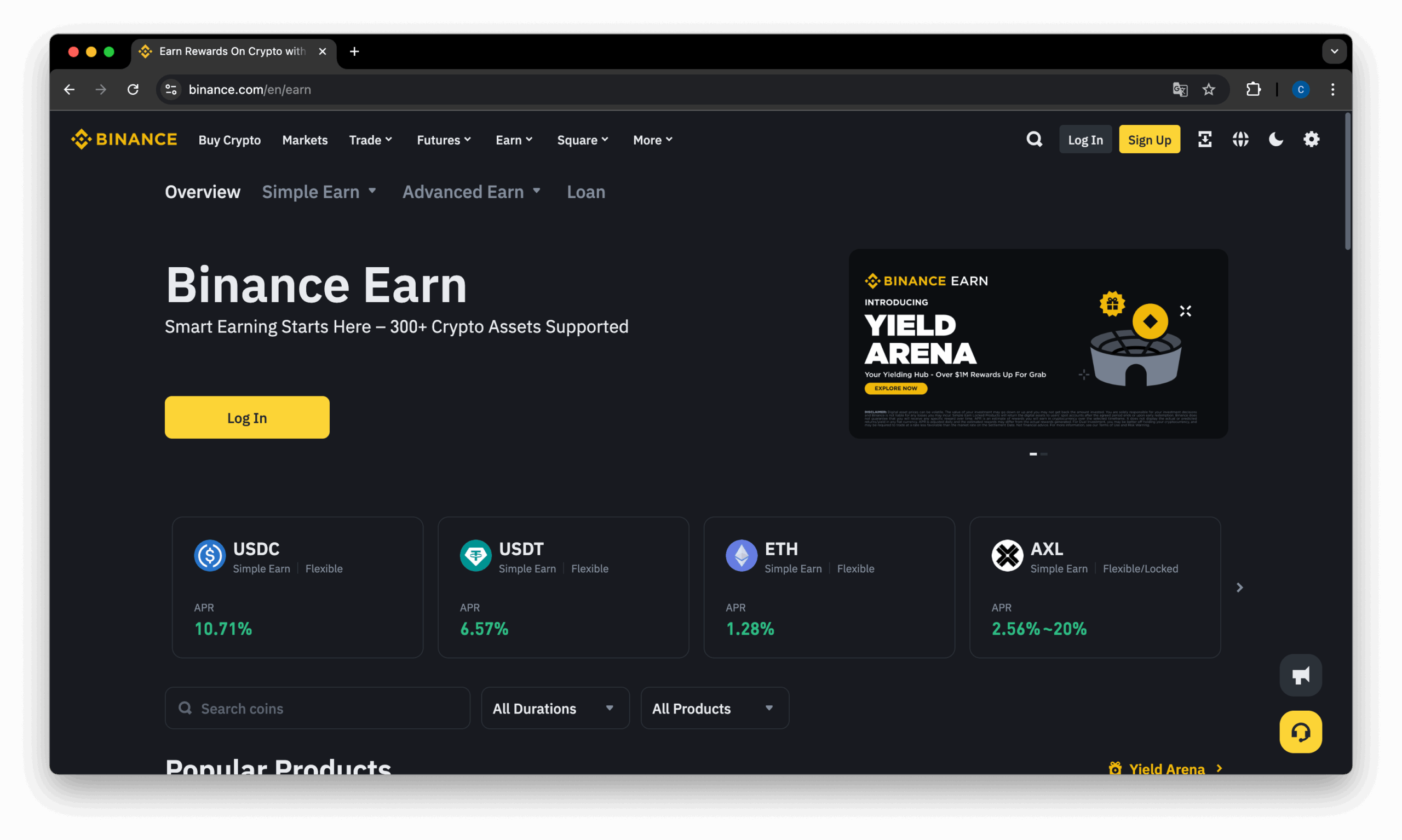

Beyond actively trading cryptocurrencies, Binance provides innovative options for earning passive income through staking and savings products. Staking involves locking up your digital assets in a secure wallet to support the network operations of certain blockchain projects. In return, participants receive rewards, often in the form of additional tokens. This process not only supports the blockchain network but also provides a steady yield for investors.

Similarly, Binance Savings allows users to lend their digital assets and earn interest over time. These savings programs typically feature flexible or fixed terms, so you can choose the product that best matches your liquidity needs and risk preference. By integrating staking and savings directly into its platform, Binance creates a seamless environment where you can both trade actively and earn returns on idle assets.

The key benefit of these products is their ability to generate income without the need for constant monitoring or active trading. For many users, this offers an effective strategy to diversify income streams while capitalizing on the growth of the digital asset market.

Innovative Trading Tools on Binance

Binance goes beyond offering basic trading products by integrating a suite of innovative trading tools designed to enhance your decision-making process. The platform features advanced charting systems that provide real-time market data, multiple technical indicators, and customizable views tailored to your trading style. These tools are indispensable for tracking market trends and analyzing price movements, providing you with the data required to make precise trading decisions.

In addition, Binance supports various order types and conditional orders that allow you to automate trade execution and manage risk more effectively. For those who appreciate data-driven strategies, the platform offers comprehensive market analytics, including trading volumes, order book depth, and historical performance data. This suite of trading tools positions Binance as not only a trading venue but also as an analytical hub for cryptocurrency markets, ensuring traders stay ahead of market shifts.

Security and Customer Support That You Can Trust

In the fast-paced world of crypto trading, security is paramount. Binance places a strong emphasis on safeguarding user assets and information. The platform employs industry-leading security measures such as two-factor authentication, advanced encryption protocols, and regular security audits to protect user accounts. An insurance fund is also in place to cover specific types of losses, which reflects the platform’s commitment to user safety.

Equally important is Binance’s dedicated customer support team. Available 24/7, the support team is well-equipped to handle inquiries ranging from account setup to advanced trading troubleshooting. Comprehensive FAQs, detailed tutorials, and community forums complement the direct support channels, ensuring that users can access help in a format that best suits their needs.

How to Choose the Right Trading Product for You

Selecting the most appropriate trading product on Binance ultimately depends on your trading experience, risk tolerance, and investment goals. Here are several factors to consider when evaluating which product may be best suited to your needs:

- Experience Level – Beginners may find spot trading and savings products less intimidating, while advanced traders might be more comfortable navigating margin, futures, or perpetual contracts.

- Risk Appetite – Products involving leverage, such as margin and futures trading, carry higher risk compared to the relatively stable spot trading environment.

- Investment Horizon – If you are looking for long-term holding and steady income, staking and savings may be ideal. For short-term opportunities or speculation, spot or derivative products could be more appropriate.

- Market Knowledge – Understanding market dynamics is crucial. Those with a deep understanding of technical analysis might benefit most from advanced trading products.

We recommend that you begin by exploring the basic products and taking advantage of Binance educational resources. Over time, as you become more comfortable with the fundamental tools, you may consider venturing into more advanced trading instruments that offer higher potential returns along with increased risks.

Steps to Get Started on Binance

Entering the world of crypto trading on Binance is a straightforward process designed to ensure security and ease of use. Follow these steps to kickstart your trading journey:

- Visit the official Binance website and navigate to the registration page using a secure referral link.

- Fill in the required account information and complete the identity verification process (KYC) to unlock full platform features.

- Secure your account by enabling two-factor authentication and other recommended security settings.

- Deposit funds using a bank transfer, credit card, or cryptocurrency transfer, depending on your preference.

- Explore the various trading sections available (spot, futures, margin, staking) and select the product that aligns with your investment goals.

By following this step-by-step guide, you can ensure that your transition into the world of crypto trading is both smooth and secure. Remember to always stay informed and manage your risk appropriately to maximize your trading success.

Final Thoughts: Empowering Your Crypto Trading Journey

Binance offers one of the most comprehensive platforms in the cryptocurrency industry, continuously evolving to meet the needs of traders around the globe. From the simplicity of spot trading to the complexity of leveraged products and staking opportunities, every trading product is designed with user empowerment in mind. By leveraging the extensive educational resources and robust security measures offered by Binance, you are well-equipped to transform market challenges into valuable trading opportunities.

As you explore these trading products, keep in mind that the key to success in crypto trading lies in understanding your own risk tolerance and continuing to educate yourself about market dynamics and evolving technologies. Binance not only provides the tools for trading but also fosters an environment where learning and growth are integral components of the experience.

Whether you choose to trade actively using margin or futures products, or prefer to earn a steady income through staking and savings, the versatility of Binance ensures that you have the right resources at your fingertips. We hope this guide serves as a valuable resource on your journey towards more informed, confident, and secure crypto trading. Embrace the power of comprehensive trading tools, maintain disciplined risk management, and enjoy the vast potential that the crypto market has to offer.